Talk of how ‘grandpa’s home only cost him £5,000’ and how ‘50p could fund a day down the pub’ is usually followed by an open-mouthed response of shock & awe amongst the younger generations that tends to overstate the real interest they have in the topic. However, if they knew that grandpa’s home had now matured into an asset that dwarfs all others, their real feelings may match their facial hyperbole.

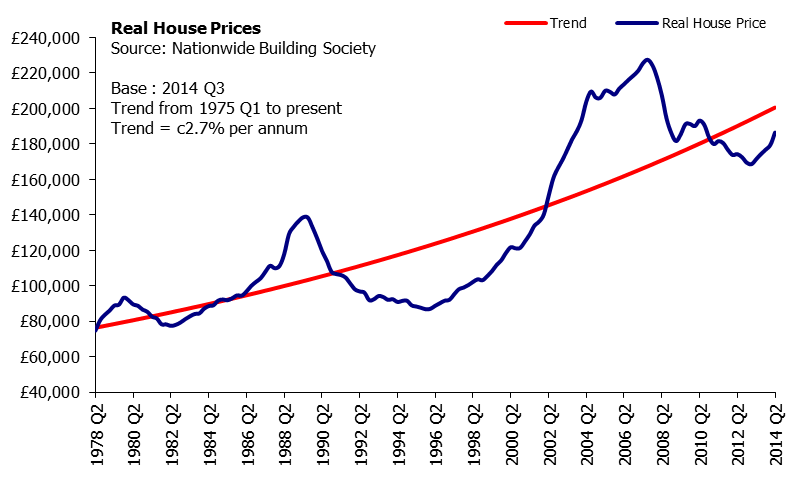

When official house price data began in 1975 the average house would set you back around £10,000; 39 years later and the hit on the wallet has multiplied 18-fold. Now, inflation I hear you say, what about the cost in ‘real terms’? Fair question, but according to a Nationwide Building Society analysis of the rise in ‘real’ house prices since 1975, the increase has still been 119% over the past 39 years. The study is accompanied by an enlightening graph (see below) that reveals how, despite the odd blip, house prices have climbed upwards at an always steady but often impressive pace.

Many people at retirement age are sitting on (or in) a potential pot of gold, unaware of the wealth tied up in the bricks and mortar that they have come to call home. With house prices now recovering following the financial crisis now is the perfect time to free up the cash tied up in your property; now is the time to take equity release.

If the upward trend in house prices continues the equity preserved following the taking of a lifetime mortgage will remain strong. For example, the Equity Release Council analysed the effects a 2% annual house price growth (the trend for the past 36 years has been 2.7% annual growth) can have on equity preservation in their Equity Release Market Report – Autumn 2014. After 16 years customers who took out a lifetime mortgage on a house worth £271,293 (average figures for H1 2014) would still have preserved over £200,000 of their equity.

Some may argue that taking out equity release if house prices are rising would negate the impact house price rises can have. Simply downsize, they would they, move away from your home and cash in on the price inflation you have benefited from over the past 40 years. However, what of the people who do not want to move? Who feel they have worked hard and saved shrewdly in order to pay for something that is a home rather than just a house? For these people they can have their cake and eat it too by taking out an equity release plan. By freeing up thousands of pounds from your home the possibilities are endless. A new conservatory? Sure. Dream holiday? Absolutely. See your children enjoy their inheritance as an early cash gift? Why not? Equity release can help the over 55s realise countless opportunities and goals, smoothing the transition into retirement whilst house price growth can preserve remaining equity to be passed on in inheritance and all from the comfort of your own home.