Self-build properties are becoming increasingly popular, with data from October 2022 showing that over 63,000 people opted to buy land and build their own homes. The benefits of such an undertaking include it being cheaper than buying a ready-made house, and being able to be more energy efficient. You might be wondering what mortgage options are available to you in this instance; in this article, we’ll aim to answer some of the key questions to help you make an informed decision.

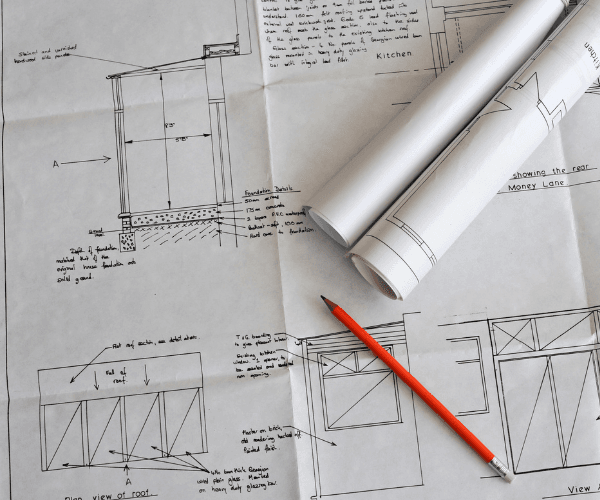

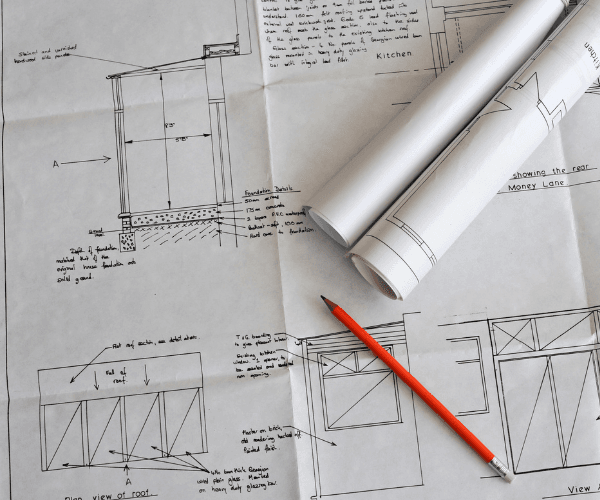

In general, self-build mortgages are harder to get than standard mortgages, purely because there are fewer products available and the application process can be more cumbersome. They work in an entirely different way than regular mortgages, with the money being released in stages so you can fund each step of the build. In order to receive a self-build mortgage, you will need to be able to show plans for the build and a breakdown of the expected costs (including the price of the plot).

You can expect to pay higher interest rates on a self-build mortgage than a standard one, and any arrangement fees can vary depending on your lender. This is down to the fact that it is more of a risk to the lender because they are loaning you money for a house that hasn’t been built, thereby losing out on their security should you default with payments. In spite of the initial increase in interest rate, it is possible to switch to a lower rate once the house has been built and signed off by a surveyor.

Whilst the market varies, you should expect to need a deposit of around 25% for the purchase of the land, and 25% towards the cost of the build itself. Of course, the larger the deposit the better, and lenders will also look at other aspects of your finances, such as credit history and income.

A general rule would be that you can borrow four times your annual salary or up to 75% of the cost of the entire build project, but this depends on a number of factors including the lender, your affordability, and the size and type of build you are undertaking.

Stamp duty is applicable for the land only, not the property or building work itself. It works out at 1% on property sales between £125,000 and £250,000, 3% on sales between £250,000 and £500,000, and 4% for those exceeding £500,000.