Equity Release

At Bower, we provide equity release advice from the whole market that help our customers to safely access tax free money from the value of their property.

For those wanting some financial freedom to maybe repay an existing mortgage, do some home improvements or finance a more comfortable retirement. Equity Release Council plans through Bower provide you with all the safeguards and guarantees so you can unlock cash from your home.

Or, if you’re ready to start the process, call our team on 0800 411 8668.

What Is Equity Release?

Equity release is a way to help people over 55 release the money in their home (the equity) without having to move from, or sell, the home they love. You also have the guarantee to stay there for the rest of your lives or move home.

Just to explain that a little more, the amount of equity available depends on the value of your home minus any outstanding mortgage and / or secured loans.

At Bower, we access all the products across the whole market to help release your equity in the way that’s right for you.

The money released is completely tax free and depending on what type of plan you choose can be accessed as either a tax-free cash lump sum or an equity release cash drawdown as and when needed.

Is equity release regulated?

Yes it is. Equity release is regulated by the Financial Conduct Authority (FCA).

Who is the Equity Release Council?

The Equity Release Council is dedicated to safeguarding consumer interests through strict standards and ethical practices. Established in 1991 as Safe Home Income Plans (SHIP) and rebranding to the Equity Release Council in 2012, the Council brings together lenders, advisers, solicitors and surveyors under a stringent Code of Conduct.

By promoting transparency and maintaining high industry standards, the Equity Release Council ensures a secure and positive experience for consumers looking to unlock their property wealth.

Is equity release safe with Bower?

Bower has been a proud member of the Equity Release Council since its launch. This means all the equity release advice and plans we provide meet the highest standards of safeguards and guarantees. These are:

- For lifetime mortgages, interest rates will be fixed or capped for the life of the loan

- You have the right to remain in your home for as long as you want to

- You can move to another home without paying any extra charges (subject to lending criteria)

- You’ll never owe more than the actual value of your home through the No Negative Equity Guarantee

- All customers taking out new plans which meet the Equity Release Council standards must have the right to make penalty free payments (subject to lending criteria)

Are there legal safeguards in place to protect me?

Absolutely. All our equity release lenders are members of the Equity Release Council and we only ever recommend equity release plans that meet their high standards. For your added protection, your solicitor will carry out all the legal work. We also have a panel of Equity Release Council independent solicitors you can choose from, if that would help.

How Does Equity Release Work?

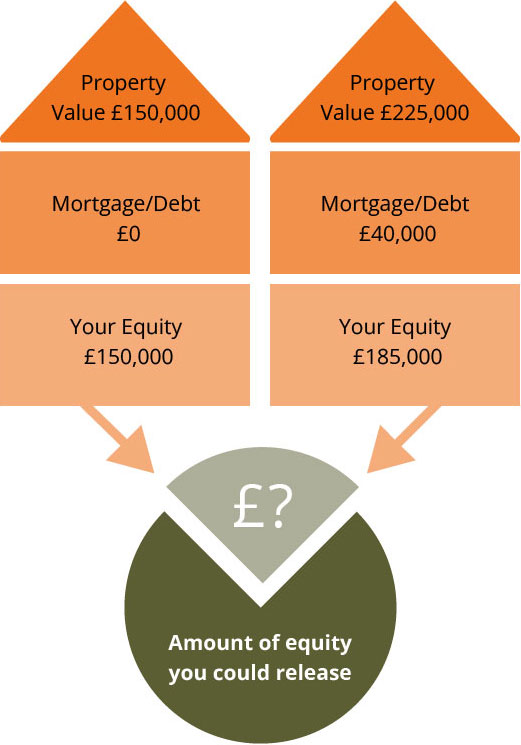

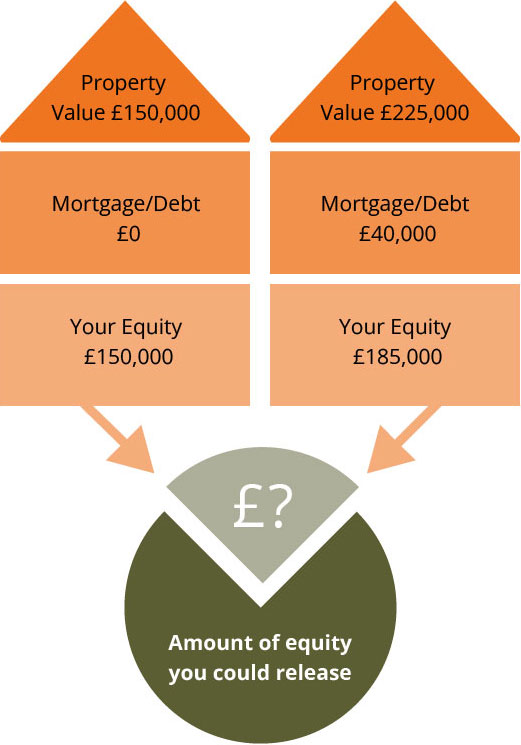

Equity release works by enabling you to access funds from the equity you hold in your property. There are many factors which will influence the amount you can release and the equity release process can be a little complex but the diagram below shows some simplified examples that may help give you a better understanding.

With no mortgage or secured debt your equity will be greater. However, there are many factors which will influence the amount you can release such as age, health and lifestyle. To get a better idea of how much money you might be able to release equity in your home, try our free equity release calculator.

If you have an outstanding amount on your mortgage, this will need to be cleared either by existing funds or through the process of releasing equity. You can then spend the remaining money in any way you choose.

Who is Eligible for Equity Release?

Equity release isn’t suitable for everyone and in order to be eligible you must:

- Be aged 55 or over (youngest applicant if you are applying as a couple).

- Own your own home worth over £70,000.

- Live in the UK.

- The property must be your main residence although there are products for buy to let and holiday homes

- Be able to pay off any remaining mortgage or secured loan with the equity you release.

What Types Of Equity Release Plans Are Available?

There are two main types of equity release products, lifetime mortgages and home reversion plans.

Aimed at those aged 55 and over, a lifetime mortgage allows you to borrow some of your home’s value at a fixed interest rate with no need for repayments, whilst being able to continue to live in the property without having to sell or move.

One of the most appealing parts of this type of equity release plan is that there can be no monthly payments may be required so you are free to enjoy the lifestyle you want without the worry or burden of repayments. The interest on the loan builds up each year and is called compound interest and both the loan and the interest are repaid from the sale of the home. This happens in the event that you choose to voluntarily pay back the loan, go into long-term care or the last person on the plan passes away.

Sometimes not known is the fact you can, if you wish, pay the interest of the lifetime mortgage which will keep the amount of the loan at the amount first borrowed for the lifetime of the mortgage. Apart from having no increasing debt and hopefully an increasing property value, an advantage of this type of mortgage is that if you wish or need to stop paying, the mortgage automatically rolls into a roll-up mortgage where the interest builds up. However, unlike a normal mortgage you cannot have your house repossessed because you stop paying, making this also a safe mortgage when it comes to the guarantee of staying in your home.

- With a lifetime Mortgage you can continue to live in your home.

- You have protection with the “no-negative equity guarantee”.

- Lifetime Mortgages allows you to access tax-free cash to spend on the lifestyle you want.

- You have the option of no regular payments.

- Lump sum or drawdown facilities are available on a lifetime mortgage plan.

- The value of your estate will decrease resulting in reduced inheritance; however, you have the option to protect an element of equity for inheritance if you wish.

- Your entitlement to certain state benefits may be affected.

- There may be financial penalties if you wish to repay or end the mortgage plan early.

- A Lifetime mortgage loan amount increases with compounded interest.

What’s appealing about a home reversion plan is that you can unlock tax-free cash from your home without any monthly repayments or roll up of interest.

Basically, you sell your home, or a percentage of it, to a provider in exchange for a discounted lump sum. You can stay in the property for life or until you want to sell it, at which point the provider will reclaim the percentage they own of the sale price (100%, 75% etc).

The home reversion company effectively grants you the right to remain in the property for the rest of your life ‘rent-free’.

How does a Home Reversion plan work?

If you sold half of your property to the reversion company, when the plan comes to an end (usually when you pass away or move into long-term care) then the money raised from the resulting sale of your home would be split equally between the reversion company and your estate.

Advantages

- Benefit from increased house price on the percentage of the property you own

- There no interest to pay on Home Reversion plans

- Your percentage amount won’t change (unless you choose to sell more)

Disadvantages

- With a Home Reversion plan you no longer own your own home

- You only benefit from increased house value on the percentage you still own

- You receive less than the market value of your home

- Less flexible than a lifetime mortgage as it can be difficult to end the plan and buy back the percentage you sold

Your equity release plan options

At Bower, our knowledgeable equity release advisers provide expert guidance on both of these equity release products, as well as advice on both the advantages and disadvantages to help find the best fit for your needs. Please see below as a guide:

Inheritance protection – you can ring fence a portion of your property’s future value to guarantee an inheritance to your loved ones.

Downsizing protection – allows you to move to a smaller home five years after taking out a lifetime mortgage without incurring an early repayment charge.

All lifetime mortgages will be fully repaid, along with any accrued interest, when you pass away, move into long-term care or permanently leave your home. Equity release may involve a home reversion plan or a lifetime mortgage, which is secured against your property.

The contents herewith do not constitute financial advice or any recommendation. To understand the full features and risks, please ask us for a personalised illustration.

It is important to note that entering into any form of equity release such as a lifetime mortgage, will decrease the value of your estate and therefore reduce how much inheritance you have to leave behind. It could also affect your tax position and eligibility for state welfare benefits. If so it will be explained and shown exactly in writing before any plan is taken out through Bower’s advice.

Click Here for more on the advantages and disadvantages of equity release plans.

Equity Release Advice Specialists

At Bower our high standards, unrivalled expertise and award-winning equity release advice service are here to help guide and support you throughout your equity release journey.

Our knowledgeable equity release advisers and customer service specialists are happy to talk you through the process, how it all works, if you are eligible and how much money you could release, as well as answer any questions or concerns you may have

We believe in the value of face-to-face meetings for a more personalised and thorough discussion about your equity release journey. We value the opportunity to meet you in person at a location of your choice, and we encourage you to involve your friends or family members in these meetings.

However, we also recognise our responsibility towards the environment. That’s why we offer eco-conscious alternatives such as phone or video calls. Whichever method you prefer, you can count on it being a safe and convenient way to access our services.

Choose the approach that suits you best – whether it’s a face-to-face meeting or a remote option – and rest assured that we’re here to provide the support you need throughout the entire process.

Contact us today for equity release advice and find out more about how it can help you access some of the value in your home to spend and enjoy as you wish!

Bower provides independent, impartial whole of market advice with an award-winning customer service experience. Initial advice is provided at no cost to you and without obligation. Only if you choose to proceed and your plan completes, would a typical advice and administration fee of £1,495 be payable.

To find out more about any of the products and the service we provide, please call us on freephone 0800 411 8668 , request a call back, email us, or join our live chat you’ll find on our website.

If you are considering equity release, we strongly recommend that you read our ‘Advantages and Disadvantages of Equity Release’ page carefully and talk to one of our specialists before deciding if you wish to proceed.

This is a lifetime mortgage or home reversion plan. To understand the full features and risks, please ask us for a personalised illustration.

How the equity release process works

Releasing equity in your home can be a complex process but rest assured, from the moment you contact Bower, we will patiently and expertly guide you through every aspect of what we do and how we work for you.

You will receive dedicated support and advice from your specialist adviser at every stage so that you never have to feel confused, unsure or alone and there will be no pressure to proceed.

For customers who are uncertain about what the equity release process entails, here we have broken down the stages for you from start to finish, to give you a better understanding of what is involved to help you reach an informed decision that is best for your individual circumstances.

After our initial phone conversation, we can arrange a visit from one of our experts or can set up a video call at your earliest convenience. You can even invite friends or family to attend if you wish, and you can ask as many questions about the equity release process as you want to.

Your adviser will take the time to get to know you and talk through all the advantages and disadvantages of each type of plan available. They will explain all of the matters you need to consider including things such as how certain plans will reduce the amount of inheritance you leave behind.

We will also conduct a full review of your entitlements to ensure that you are claiming all the state benefits that you are eligible for. In some cases, a plan can be structured to minimise any impact on means testing and in some cases, there may be no impact at all.

At Bower, we never put you under any pressure to go any further than this initial chat, in fact, we don’t even expect you to make any decisions at this point.

It’s simply an opportunity for us to meet, talk about the equity release process and get to know each other. It is important to us that everything is done at a pace that our customers feel comfortable with and only once they are clearly and fully informed of every aspect of the plan will we continue if they so wish.

If you are happy with everything that is discussed during the initial consultation, your adviser will return either in person, call over the phone or via video chat after a few days with a full recommendation of the best options for you, which may or may not include an equity release plan.

If equity release is recommended then we will show you which plans you qualify for, what particular one we suggest for you and explain why, as well as details on exactly how much you could release and the costs involved.

We will also give you the results of your state benefits entitlement check and notify you if the ones you qualify for could be affected by an equity release plan.

If you decide that there is a plan that you think will provide you with what you need and you want to proceed then your adviser will take you through the paperwork to get the process started.

Your dedicated adviser will take care of everything from start to finish. They will work hard on your behalf to ensure the whole process runs as smoothly as possible, liaising with your chosen solicitor and your lender when necessary to keep things moving along.

They will always be there to answer any of your questions and will keep you updated at every stage so that you know how your case is progressing, and how close you are to receiving your money.

After your plan completes, we provide a full after care service which enables you to discuss anything you wish about your existing plan at no cost.

It’s really as simple as that.

The Bower Difference

If you decide to go ahead with the suggested equity release plan recommended by our independent, impartial financial advisers, we will work with you to ensure:

We will keep you fully informed of the process every step of the way.

In the future, you may need advice or assistance concerning your equity release plan. We can provide you with a lifelong after-care service so that you can keep in touch with us for as many years as you wish, to ensure that you are completely satisfied with your plan.

Our expert advisers are highly trained specialists in the field of retirement lending. With an impressive record of expertise and qualifications, you will always receive high quality, professional advice. Your individual needs will always come before a sale, and if our specialists do not think a particular product is right for you, they will advise you on better suited alternatives.

We will deal directly with your equity release solicitor and equity release provider to move things along so you don’t have to worry about a thing.

Bower is your specialist in retirement lending and we are absolutely dedicated to ensuring that you receive the very best service throughout your journey with us.

When you call Bower during office hours you’ll speak to one of our friendly team members here in our UK-based contact centre and once you have met with your local adviser you can simply call them whenever you have a question. It’s all part of our award-winning, bespoke service designed around your specific needs.

We will provide your equity release solicitor with a copy of your personalised report so that they are fully aware of your situation before signing your ERC (formerly SHIP) certificate.

Your specialist advisor will explain everything during your first appointment and give you the space and time you need to make a decision. There is never any pressure to proceed, we are only here to offer genuine support and friendly, expert advice from a company you can trust.

With Bower, you never need to leave your home to speak to one of our specialists. We will either come out to see you there, or you can speak to us over the phone or by video call, whichever works best for you.

We will keep you fully informed of the process every step of the way.

We want you to feel empowered and confident that you know everything you need to know about the products you are considering. That’s why we speak directly and truthfully without any technical jargon or complicated industry terms.

The Pros and Cons of Equity Release

As some people get close to retirement age or enter later life they find the need for additional income. One way to access some cash is with an equity release plan which can provide the funds to go on some much deserved holidays, make home improvements or simply enjoy retirement, whilst continuing to live in your property.

Equity release can be a great option for some people, but it is a major financial decision which should never be taken without independent professional advice.

Here’s our guide to some of the pros and cons of equity release, helping to answer those vital questions with informed, accurate, objective, fair and balanced information you can trust.

Is Equity Release right for everyone?

There is no ‘one size fits all’ when it comes to financial products such as equity release and what suits one person could be detrimental to another.

At Bower, we take the time to ensure that any decision you make is right for you and your individual circumstances. We always suggest to our customers that if they wish, they can involve their family in the entire process, allowing for clear, honest and open communication about the impact of equity release.

If our advisers feel that equity release is not the right product for you, then they will let you and your family know straight away and offer guidance on alternatives that may be more suitable to your needs.

What are the Pros and Cons of Equity Release?

Equity release can be a great way to turn your property into a cash lump sum or source of income, but this comes with some big implications which is why it’s important to fully understand and comprehend all of the advantages and disadvantages of these plans.

- You can continue to live in your own home, rent free, for the rest of your life or until you move into permanent residential care.

- The ‘no-negative equity guarantee’ means that you will never have to repay more than the value of your home and your estate will never owe more than the property is worth when it is sold.

- The tax-free cash that you release can be used for anything you like from home improvements, clearing a mortgage or debt, to the holiday of a lifetime.

- With many plans, there are no regular payments to make, the option is yours.

- The flexibility of modern equity release plans means that you can release the money as a lump sum, or a lump sum with a drawdown facility.

- The value of your estate will reduce and the amount you can pass on in inheritance via your estate will therefore also decrease.

- Your entitlement to certain state benefits may be affected.

- If you wish to repay or end the plan early there may be financial penalties in doing so.

- Some lifetime mortgages are paid back with compounded interest meaning that over the longer term the amount you owe can grow quite quickly.

- You should always consider the alternatives. Equity release is just one possible option for acquiring tax-free money from your home; downsizing, asking family for help or taking out an unsecured loan are some other options.

Impartial Equity Release Advice You Can Trust

If, having read all those advantages and disadvantages, you would like to know more about the pros and cons of Equity Release, just get in touch with the Bower team today and our knowledgeable advisers will be happy to answer any questions you may have.

Our home finance specialists are here to help our customers make smart, safe, informed decisions by providing open, honest, impartial advice – always.

Jargon buster – equity release words and phrases

No-one likes jargon, especially when it comes to talking about your money.

At Bower, we want to be absolutely sure you’re clear about everything we discuss so you can make an informed and confident decision about your equity release.

So if you’ve read or heard anything about this that you want explained or clarified, then just pick up the phone and talk to us.

In the meantime, here’s our A to Z guide to some of the most commonly questioned words and phrases about equity release (and all the jargon for interest-only mortgages!).

Equity Release Schemes

Over recent years, the equity release industry has moved on in leaps and bounds with the introduction of new equity release products.

At Bower we are experts on both types of equity release plans – Lifetime Mortgages and Home Reversion plans.

What Are The Key Differences Between The Two Plans?

Both home reversion plans and lifetime mortgages allow you to release some of the equity tied up in your home to spend as you wish. You are also able to continue to live there, without the risk of losing your home, until the end of the plan which finishes once you pass away or move into long term residential care.

However, these two plans are actually very different products with some key distinctions between them, including;

- A lifetime mortgage loan is secured against your property.

- A home reversion plan works by selling some (or all) of your property below market value to an equity release provider.

- With a lifetime mortgage, you remain the owner of the property.

- With home reversion plans you no longer own all of the property, only what you haven’t sold to the equity release provider

- Lifetime mortgages don’t usually require any repayments to be made during the lifetime of the plan, unless you choose to.

- Home reversion plans allow people to remain in the home under a lifetime lease (usually rent free) for the rest of their life.

- When you take out a lifetime mortgage, you agree to a fixed interest rate which over the years is added as compound interest.

- Home reversion plans are not classed as a loan, so therefore there is no interest added.

Which Plan Will Be Most Suitable For Me?

Although both of these equity release schemes allow eligible homeowners to access some of their property wealth whilst being able to remain in their home, as with everything there are advantages and disadvantages to both and it is worth taking the time to consider your options carefully before making a decision.

In terms of suitability, choosing the right plan could depend on:

- How much money you wish to access (Complete our free online equity release calculator to find out how much you could access)

- If you want to release any money at a later date with a drawdown facility

- If you plan to downsize or move in the future

- The value of your property

- If you plan to pay off all or some of the lifetime mortgage in the future

- Whether you want all of the money right now

- The ages of you and your partner (if applicable)

- If you wish to guarantee an inheritance for your loved ones

- Any outstanding mortgage even a lifetime mortgage

- Your health and lifestyle (see ‘How much equity can I release?’)

At Bower we take all of these factors and more into account during our advice process where we help our customers make an informed decision. Only when all these factors have been discussed can a recommendation be made which may be an alternative solution to equity release.

Independent Financial Specialists You Can Trust

At Bower we use our knowledge and experience to provide our customers with the clear and impartial advice, guidance and information they need to make a decision that is right for them and their circumstances.

To find out which type of plan is best for your individual needs and circumstances, simply get in touch via our online contact form or call on – 0800 411 8668 and we’ll arrange a free, no-obligation consultation in the comfort of your own home with one of our expert advisers.

FAQS

As with most things, there are of course pros and cons associated with equity release which is why it is important to be fully informed and aware of what you are entering into. For those that decide to proceed, there are many advantages to choosing equity release, such as;

You retain full legal ownership of your property with a lifetime mortgage and remain the homeowner.

The no negative equity guarantee means that you or your estate will never be required to pay back more than the property can be sold for.

If you choose a lifetime mortgage, then you have the option to receive your money in either a one off lump sum or a smaller cash sum and a reserve of cash from which to draw from.

If required, in some circumstances inheritance can be safeguarded with a percentage of your home’s value left behind for loved ones. This will however reduce the amount you can borrow.

These types of mortgages are portable which means that if you move home then a lifetime mortgage can transfer to a new property as long as the new property adheres to the lending criteria.

It is always important to think carefully and talk through big decisions with an independent financial adviser and trusted family members. Although there are many great benefits to equity release there are some risks that homeowners should always be made aware of beforehand:

- When you release equity, it can affect things such as welfare benefits and your tax position which is worth looking into.

- Although in some circumstances you can choose to safeguard a percentage of your property’s value to be left as an inheritance, the amount available to your beneficiaries will still be reduced after the lifetime mortgage has been paid off.

- The interest is compounded, which means that over time, interest will be charged on interest.. When you go into long term care or pass away as per the terms and conditions, the property is sold, and the interest repaid from the sale of your home.

- Equity release is considered to be a long term or lifetime commitment. However if you choose to end your mortgage early then there can be early repayment charges.

Equity release can be a great option for a lot of people but whether it is the right choice for you will depend on your individual circumstances such as:

- Your age

- Your total income

- How much cash you are looking to release

- What your plans are for the future

A lot of people tend to focus on the immediate cash boost that they will receive with their equity release but it’s also important to properly research, understand and consider the possible long term effects for later in life.

Before you make any decision, be sure to speak to a professional equity release adviser who will be able to offer expert advice and suggest alternative solutions if they think it isn’t the right option for your needs.

Yes, there are also two main types of equity release in Northern Ireland

- Lifetime Mortgage – This is the most common type of plan that helps people over 55 borrow money secured from the value in their home.

- Home Reversion Plan – This allows people to sell a share or all of their property in return for a tax-free lump sum or smaller regular payments

At Bower, we have specialist equity release advisers based in Northern Ireland, Belfast and Derry who fully understand the local market.

Important Information

At Bower, we will understand your unique circumstances and advise you to ensure you are receiving the best plan to meet your objectives. There are plans that allow you to make voluntary repayments and move home, subject to lender criteria. However, early repayment charges may apply in certain circumstances.

Equity release requires paying off any existing mortgage. Any money released, plus accrued interest to be repaid upon death, or moving into long-term care. Equity release will reduce the value of your estate and your entitlement to means-tested benefits now or in the future, and impact long-term care funding.

Bower Home Finance provides independent, impartial whole of market advice with an award-winning customer service experience. Initial advice is provided at no cost to you and without obligation. Only if you choose to proceed and your plan completes, would a typical advice and administration fee of £1,495 be payable.

If you are considering equity release, we strongly recommend that you read our ‘Advantages and disadvantages of equity release’ page carefully and talk to one of our specialists before deciding if you wish to proceed.

Equity release requires paying off any existing mortgage. Any money released, plus accrued interest to be repaid upon death, or moving into long-term care. Equity release will affect potential inheritance and your entitlement to means-tested benefits both now and in the future.